Posted: September 17th, 2011 | Author: jenny | Filed under: Uncategorized | 1 Comment »

Last month there was a story in the LA Times about a local artist who got into a bit of a row with officials over his inflammatory artistic vision. The guy was on the street working on an oil painting of a Chase Bank branch in Van Nuys… depicting the roof as entirely engulfed in flames! Police were called out, and before the paint was dry on the canvas he found himself being questioned as a terrorist. Now he’s back in the news. That painting just sold for $25,000 to a German collector.

Joseph Campbell called the artist the “shaman” of modern society, in that the artist explores the spiritual realm, retrieving artifacts and insights that offer understanding and healing to the culture at large. Art facilitates the evolution of spiritual mythos through creating visual language. In this context, Alex Schaefer might even be called an exorcist.

Schaefer’s new series of en plein air paintings depicting banks on fire certainly strikes a nerve. It is also humorous. His work is similar in spirit to the Dada movement of the early 20th Century, but with all the blunt sarcasm of Punk Rock. The effect is cathartic and pleasurable. The viewer is provided with a much needed moment of Schadenfreude, as economists like to call that sweet feeling of enjoying someone else’s misfortune.

Schaefer worked in video games for years before deciding to focus his attention on the finer arts. He now teaches painting and drawing at Art Center College of Design in Pasadena. Â After being questioned by police on the sidewalk while he painted, he was visited weeks later at his home in Eagle Rock by two plainclothes detectives.

“One of them asked me, ‘Do you hate banks? Do you plan to do that to the bank?’ ”

Schaefer explained the image was only symbolic.

“The flames symbolize bringing the system down,” he said. “Some might say that the banks are the terrorists.”

He is surprised by the attention he’s been getting for his work. After his story was featured in an article in the Los Angeles Times, Schaefer started to receive offers for his burning bank paintings. He decided to put the one of the bank in Van Nuys up for sale on e-bay, and received over 70 bids before selling it. Â Oh, the irony… first he’s stopped for burning banks and now he’s laughing all the way to one.

http://youtu.be/Pa4Gl7DU3cQ

The Huffington Post

Alex Schaefer, Burning Bank Artist, Sells A Piece For $25,200

September 13, 2011

http://www.huffingtonpost.com

Los Angeles Times

Artist’s Burning Bank Paintings Are Hot Commodities

Bob Pool

September 13, 2011

http://articles.latimes.com

Los Angeles Times

An Artist’s incendiary Painting is his Bank Statement

Bob Pool

August 28, 2011

http://articles.latimes.com

Posted: August 31st, 2011 | Author: jenny | Filed under: Uncategorized | No Comments »

What happens when the people in charge of coming up with a solution to the banking crisis are the same people who created the banking crisis in the first place? Let’s take a peak into the kitchen on Capitol Hill to see what they’re putting together now. Mmmmm… do I smell books cooking? It seems Washington, in all its glorious cronyism, is hard at work again helping the banking system mix up a final solution to the problem of mortgage backed security debt.

Some have described it as the biggest heist in history. The largest banks in America systematically defrauded investors over a span of years in the effort to reap huge profits, salaries and bonuses. The victims were individual homeowners, foreign investors and pension funds worldwide along with anyone else who’s net worth has been hit by the current economic downturn. The blame does not lie entirely on banks and financiers. The responsibility of managers who bought into the racket must be questioned, as well as those who decided to sign up for loans they could never possibly pay on the salaries they were bringing in. But the fact is, the rotten securities investors bought held the highest quality ratings possible. Mortgage backed securities with an over fifty percent likeliness of failure were labelled as AAA, the safest rating possible. This was just pure deception, and the banks and lenders hawking these products were well aware of it.

Throughout the economic hardship of the past five years I have taken solace in the idea that one day justice would be served and the big banks would see their due day of reckoning. Watching the government pouring our tax money into their coffers has been discouraging, to say the least, but I always knew it wasn’t going to save the institutions in the long run. It just wasn’t enough money. During the boom years the financial industry created eight trillion dollars of phony housing wealth through the origination of property loans, refinancing contracts and derivatives. The bubble popped when the bill came due and homeowners found they just didn’t have the funds to pay up.

Banks found they were facing insolvency. They realized they’d never get the money back on trillions of dollars of bad loans they’d made. They called it a national emergency and convinced us the whole economy would crash and burn if they didn’t get some support. Under President George W. Bush, a stimulus package was crafted in Washington to prevent the economy from tumbling into depression. The banks gladly took the government stimulus money and used it to bolster their falling bottom lines. The economy crashed anyway, but the banks were saved. Or were they?

The problem is, the debt load was just too big for most banks to bear. Stimulus money helped bolster reserve funds, but wasn’t near adequate to cover imminent losses. Foreclosures began to rise as homeowners found they were unable to make payments on loans they should never have been approved for. Banks repossessed properties, but in most cases could not sell them for enough to cover the amount owed on the loans due to deteriorating housing prices. Banks needed accounting rules to change if they were to avoid collapse. And so the rules were changed. A new provision was established that would allow banks to keep housing stock on their books at the value it held when they’d made the loans. In other words, instead of valuing the properties at what they would actually sell for in the falling market, they were able to value them at the inflated prices they’d been appraised at during the bubble years. This allowed banks to claim their assets were worth far more than they actually were, which made them look far better capitalized and healthier than they actually were.

You can see the charade that was put into place here. This new accounting approach was really just a bit of trickery to keep up appearances in the short run, but was clearly without any power to fix the underlying problem of potential insolvency… extend and pretend, a bit of con to hide the con.

If they had to be honest, most banks would be in much worse shape than we realize. Many might even be out of business. In fact, we have seen a record number of banks go under since the beginning of the crisis and more follow suit every week that passes. The nation’s largest banks have been protected. Deemed “too big to fail” by the powers that be, they have not been allowed to see the consequences of their bad investments. Capitalism has not been allowed to run its course. The press reassures us that banks are back on solid ground, but it is highly unlikely. Impossible, really. The bubble was too big, and its deflation is still underway.

The irony is the housing bubble was created in large part by the very system that is now threatened with collapse as the bubble deflates. The financial industry brought this fate upon itself. The Frankenstein monster they’d breathed life into escaped from the castle and tore apart the village, but is now tearing at the kitchen door trying to get back inside. We might imagine that in time, when all the accounting tricks and shell games are forced to their natural ending, justice will finally be done. Banks will eventually have to pay the piper for the havoc their monster wreaked upon the village as they cherry picked the loot left in its path of destruction. At least, I have taken solace in this thought as we’ve endured the terrible injustices and torment the economic crisis has wrought upon the poor and middle classes while the rich banking class prospered.

How was the great heist pulled off? Just how badly have banks been behaving? The roots of today’s crisis can be traced at least as far back as Reagan’s presidency and the onset of an era of deregulation, but at the heart of the recent collapse lies the housing bubble. The banking industry, with its ties to real estate financing, was key in blowing the bubble. There are numerous offenses still to be properly investigated regarding bank misbehavior, from fraudulent paperwork on loans to mass tax evasion due to the failure to pay fees on deed transfers and mortgage registrations. But the worst of the criminal activity lies in the creation and marketing of mortgage backed securities. This involved a systematic global con with banks using the complexities of the securitization process to disguise highly risky toxic assets as extremely safe investments, in order to steal vast sums of money from the unwitting public.

Heading up the Federal Reserve at the inception of the housing bubble was Allan Greenspan, who set the stage with his anti-regulatory stance and his implementation of artificially low interest rates. He failed to address the risk of fraud in the derivatives market when in 1998 he stifled warnings from of the Commodity Futures Trading Commission regarding inadequate transparency and regulation of mortgage backed securities. Banks lent money to corrupt companies like Countrtywide and New Century, who made extremely risky loans, cut them up into tiny pieces, mixed the pieces all up with a few clippings from healthier loans and bottled the mixture with a AAA rating on the label. The lenders then sold this swill back to the banks at an outrageous profit. They did this for years, creating huge sums of money for banks to lend out in order to create more toxic securities. The practice ultimately ruined millions of peoples lives globally and decimated the economy.

To justify their actions in creating toxic mortgage backed securities, banks used the sort of logic that says if you mix a small amount of rotten meat into a large amount of good fresh meat only a few folks will get sick eating the hamburgers made from it. The problem was the ratio was skewed and most of the meat going into the mixture was rotten. So basically everyone got sick eating the stuff, eventually even the banks themselves. Despite the Federal Reserve’s spending billions buying up toxic securities from banks during their latest attempt at quantitative easing, banks are still sitting on huge pools of mortgage backed securities and other derivatives of questionable worth that continue to decline in value. And now the piper is calling for his pay. No one knows exactly what these assets are worth, due to their complexity and to the fact that housing prices are still falling, so we cannot even properly assess the financial standing of most large banks today.

To justify their actions in creating toxic mortgage backed securities, banks used the sort of logic that says if you mix a small amount of rotten meat into a large amount of good fresh meat only a few folks will get sick eating the hamburgers made from it. The problem was the ratio was skewed and most of the meat going into the mixture was rotten. So basically everyone got sick eating the stuff, eventually even the banks themselves. Despite the Federal Reserve’s spending billions buying up toxic securities from banks during their latest attempt at quantitative easing, banks are still sitting on huge pools of mortgage backed securities and other derivatives of questionable worth that continue to decline in value. And now the piper is calling for his pay. No one knows exactly what these assets are worth, due to their complexity and to the fact that housing prices are still falling, so we cannot even properly assess the financial standing of most large banks today.

Now the government is involved again, busily cooking up a brand new rescue plan for the financial industry. That’s right, rather than conducting a proper investigation into the criminal behavior of the banking sector, the government is attempting to find a quick fix by throwing more money at the problem. It is pretty horrific. It looks like a cover up. I am shocked, frankly. But, this is my folly. Why would I expect anything different from Washington? They’ve been in bed with the big banks from day one, through the blowing of the bubble and through its collapse. This is probably due to the fact that the biggest players in government economic policy came out of the banking industry, like Secretaries of the Treasury from the past three administrations, Larry Summers, Henry Paulson, and Tim Geithner, for example. This is cronyism at its finest. Look at the net worth of these guys. They’re all very wealthy and most likely profited in some capacity from the greatest rip-off known in Western history, themselves. Do you think they’re going to be looking out for your best interests? Maybe if you’re a Wall Street fat cat!

With so many bankers in the kitchen, the latest plan to deal with the mortgage crisis looks nothing like justice. Though Obama resisted it initially, he has been swayed into agreement. His administration, along with the banks and the state attorneys general have come up with a deal that would allow the culprit banking industry to walk away from a generation of unparalleled fraud practically unscathed. For a combined penalty fee of just $20 billion, to be shouldered by the entire banking industry, all future obligations associated with the mortgage backed securities fiasco would be dropped. The deal would also block efforts by defrauded investors and victims of unfair foreclosures to obtain any relief through the civil court system. The settlement amount of $20 billion would go toward more useless loan modifications and counseling for distressed homeowners.

This plan is so outrageous I don’t know where to begin my criticism. The most striking injustice is, of course, the amount the banks would be held responsible for… or NOT held responsible for, perhaps I should say. We are talking about an $8 trillion dollar housing bubble – an $8 trillion dollar loss of wealth – and the whole banking industry gets off with a combined fee of $20 billion and no criminal investigation? In 2008 the state pension of Florida alone lost more than $62 billion, and that’s a drop in the bucket of what the damage will have cost by the time this thing runs its course. To add insult to injury, the banking industry is balking at paying even that amount and so it will likely be negotiated down.

So who is left to ride in on horseback and upset the pots? There is one ray of hope, and it shines from the scales of New York Attorney General, Eric Schneiderman. He has taken a stand against the proposed deal. He is conducting his own investigation into the mess of toxic securities and refusing to sign on to the new deal. In order for it to fly, the proposal has to have all 50 states along with the federal government on board. It can’t move forward without his participation. Insiders are furious, but he’s not backing down.

“The attorney general remains concerned by any attempt at a global settlement that would shut down ongoing investigations of wrongdoing related to the mortgage crisis,” a spokesman for Mr. Schneiderman told the press.

So there is hope still. Perhaps our brave maverick spokesman will save the day yet. In the meantime, purveyors of the new settlement remain intent on stamping out any spark that might lead to actual justice being done, and are doing all they can to sugar coat the bitter pill and get it down the throat of the public. It is being touted as a grand new effort to help troubled homeowners. With his approval scores hitting new lows these days, it’s just the kind of promo Obama needs as he heads into next year’s elections.

So there is hope still. Perhaps our brave maverick spokesman will save the day yet. In the meantime, purveyors of the new settlement remain intent on stamping out any spark that might lead to actual justice being done, and are doing all they can to sugar coat the bitter pill and get it down the throat of the public. It is being touted as a grand new effort to help troubled homeowners. With his approval scores hitting new lows these days, it’s just the kind of promo Obama needs as he heads into next year’s elections.

Alisa Finelli, a spokeswoman for the Justice Department had this to say promoting Washington’s corrupt new proposal: “The Justice Department, along with our federal agency partners and state attorneys general, are committed to achieving a resolution that will hold servicers accountable for the harm they have done consumers and bring billions of dollars of relief to struggling homeowners – and bring relief swiftly because homeowners continue to suffer more each day that these issues are not resolved.”

Whoa. Beware the justice of the Justice Department! In their arguments to support the passage of this new plan they have been careful to keep the focus on issues surrounding foreclosure improprieties like “robosigning” and the apparent prolific use of forged documents, but implementation of the plan would also require attorneys general to sign broad releases preventing them from bringing further litigation on all other matters relating to improper banking practices. This would include anything to do with the vast reaching white collar criminal heist banks took part in to turn crap loans into AAA securities and foist them on the public.

So as the rich grow richer and the poor grow poorer across the ever widening economic divide in this country, the chefs of Capitol Hill are busy preparing their new concoction for the marketplace. Something will be served cold, but it won’t be vengeance and most certainly won’t be justice. More likely they’ll be serving up something else to make you sick. Probably best to order off the menu. I’ll be sitting at Schneiderman’s table.

Rolling Stone

Obama Goes All Out For Dirty Banker Deal

Matt Taibi

August 24, 2011

http://www.rollingstone.com/

New York Times

Attorney General of N.Y. Is Said to Face Pressure on Bank Foreclosure Deal

Gretchen Morgenson

August 21, 2011

http://www.nytimes.com/

About.com

Role of Derivatives in Creating Mortgage Crisis

Kimberly Amadeo

October 13, 2011

http://useconomy.about.com/

Posted: July 27th, 2011 | Author: jenny | Filed under: Uncategorized | 1 Comment »

How long do we have to wait for housing prices to return to an affordable level? I am incredibly frustrated by how slow the process is.  Billions of tax dollars have been thrown at the housing market to prop up prices. It has done nothing but slow price discovery and make the banking class richer. It’s as though no one cares there’s a whole generation of young people with no foreseeable pathway to ever buying property of their own. It is a terrible injustice.

Potential responsible home buyers (disclosure: like me!) continue to sit on the fence, waiting for the old formulas for buying safely to someday make sense again. Like, how about the idea of not spending more than three times your annual income on the price of a home? Or keeping the monthly combined cost of your mortgage, insurance, taxes and maintenance comparable to what it would cost to rent the same property? These old ideas seem entirely outmoded and ludicrous after enduring the mental distortion of the bubble years, but this only serves as testament to the high degree at which such distortion in the market and in our thinking persists.

Most of Generation X is either dealing with the consequences of having spent way too much on a house during the bubble, or is laying low waiting out the storm and growing old renting. Younger people have it even harder. They are putting off having families. They are living with their parents, unable to find work or service expensive college debt let alone get anywhere near working toward home ownership. The old privileges of the middle class are no longer available to the wide group they once were. The wealth of the middle class is being transferred to the top. All the government intervention in housing we’ve seen over the past five years has made matters worse and threatens to drag the pain out for years to come.

As we say goodbye to the Fed’s QE2 program to purchase the mortgage backed securities no investor in their right mind would buy (because they’re a complete pile of worthlessness), we can expect to see another round of government effort to prop up  housing prices by the powers that be. A couple of days ago I read in the Wall Street Journal that President Obama mentioned during a recent town hall meeting on Twitter he has some new ideas brewing regarding further support for housing. The administration is looking into the possibility of creating incentives designed to lure investors into the market. One such plan would require taxpayer-owned mortgage giants Fannie Mae and Freddie Mac to relax their rules for lending to investors.

housing prices by the powers that be. A couple of days ago I read in the Wall Street Journal that President Obama mentioned during a recent town hall meeting on Twitter he has some new ideas brewing regarding further support for housing. The administration is looking into the possibility of creating incentives designed to lure investors into the market. One such plan would require taxpayer-owned mortgage giants Fannie Mae and Freddie Mac to relax their rules for lending to investors.

OMG. Really!? This latest idea sounds to me as though they intend to have the already struggling middle class pay to have rich investor types buy up all the real estate and keep prices out of reach for everyone else. In other words, the government’s intention is to support all the forces that blew the market into a bubble in the first place. This is already the case with the misuse of FHA lending to allow middle and high income buyers to purchase overpriced homes in desirable urban areas with close to no down payment, and with how caps on conforming loan limits were raised at Fannie and Freddie to accommodate ridiculously inflated bubble prices. Government loans and incentives have essentially taken the place of all those toxic mortgage products that are no longer available because they led to financial meltdown. People are still being lured into risky investing on overpriced property, with the taxpayer covering the risk.

In a quote from his Twitter town hall meeting on July 6th, President Obama clearly states the government’s goal is to raise home values.

“I think the continuing decline in the housing market is something that hasn’t bottomed out as quickly as we expected. And so that has continued to be a big drag on the economy. We’ve had to revamp our housing program several times to try to help people stay in their homes and try to start lifting home values up.”

There’s a bit of an Orwellian aspect to these statements. Â Is Obama saying he wants housing to bottom out or does he want to re-inflate the bubble so it can’t bottom? Â I suppose the administration has been hoping to engineer a price bottom, but alas market dynamics don’t work that way. Â In either case, the “Making Home Affordable” campaign seems like a bit of a misnomer when the larger goal is clearly to lift home values from already hyper-inflated levels no one can afford to begin with.

In the short run, propping up the market creates the illusion of wealth and recovery. It can be argued that this illusion is important to maintain so people don’t fall into a state of panic. We have softened the crash and therefore have possibly prevented what some argue would have turned into a more devastating financial depression than we’ve experienced. Proponents of economic stimulus maintain that is indeed what we have achieved with our public investment in housing and banks. So perhaps the effort wasn’t entirely worthless. No one is sure how things would have played out had we just kept our hands off the correction. However, in the long run our insistence on keeping the housing bubble inflated does not come without adverse consequences.

The adverse consequences are troubling and abundant. One consequence of the buoying of housing prices is that first time hopefuls and young folks can’t afford to buy. The young middle class that traditionally sustained the market has been driven out. There is no new generation of buyers. This will prove problematic for baby boomers, who as a whole have not adequately saved for retirement and are counting on the equity in their houses to provide a nest egg. As we spend our tax dollars covering bad bets in the housing market, the middle and lower classes fall further into debt and the gulf between rich and poor grows wider. On top of that, the very homeowners that some of these programs were designed to help have mostly just been further drained financially on property they can’t really afford and will likely lose anyway. In the meantime, “too big to fail” banks have grown even bigger with stimulus money and mergers. As housing stagnates, the economic crisis drags on and the threat of a long term deflationary period grows with the potential of inflation problems even farther along the path.

in the housing market, the middle and lower classes fall further into debt and the gulf between rich and poor grows wider. On top of that, the very homeowners that some of these programs were designed to help have mostly just been further drained financially on property they can’t really afford and will likely lose anyway. In the meantime, “too big to fail” banks have grown even bigger with stimulus money and mergers. As housing stagnates, the economic crisis drags on and the threat of a long term deflationary period grows with the potential of inflation problems even farther along the path.

The thing is, no amount of stimulus or subsidizing will hold back the housing correction over the long term. In this sense it is ultimately wasted money. We have already poured billions into the effort and nothing has stopped the downward trend. The Bush administration’s TARP program, for example, only served to prop up banks and other financial corporations. The “too big to fail” financial sector was provided with cheap loans to keep business going, but used the funds to bolster their own faltering balance sheets instead of lending anything out. This did little to stimulate home sales or lubricate the housing market. It did not stop home values from plummeting. Prices have fallen 30% nationally since the implementation of TARP, and more than 50% in some harder hit areas.

The results produced by the HAMP mortgage modification programs have been equally anemic. First, these programs have essentially done nothing to reduce what is owed on the vastly overpriced homes people bought during the bubble years. The modifications merely lengthen the pay back time or lower the interest slightly so the monthly nut is less. People are left on the hook for a lifetime of debt with all their money going toward paying off their homes. Secondly, most modified loans end up in default anyway because they do not actually make homes affordable. In most cases even the reduced monthly payment proves too much for most homeowners to bear. The government’s mortgage modification programs have merely provided a way for banks to squeeze even more money out of homeowners who will end up in default anyway.

Remember the tax credits offered to people buying homes at the beginning of the year? That did actually turn the market around for a moment – even drove prices up in some areas. It was ironic to see some people chasing $6,500 or $8,000 tax credits on properties where the price had been pushed up $20,000 by the temporary demand. In Los Angeles, where I live, the frenzy even led to bidding wars! Of course, the upward bounce ended abruptly as soon as the credit offer ended, and the market quickly resumed it’s downward spiral. In another layer of irony, national home values have now fallen more than the amount the credits provided. I was just reading that in the San Fransisco Bay area the median home price fell $38,000 just in the month following the expiration of the tax credit offer.

These are just three examples of the failure of government intervention to have any long term impact on raising prices in the housing market, but the list goes on. There have been five times as many programs designed to support housing employed since the correction began, and all have ended with a similar lack of success. The fact is, the deflation of the housing bubble is an event more vast and powerful than most people understand, including most economists and leaders in Washington. It is the nature of bubbles that all the wealth they create is lost in the wake of their popping. To slow that process is just to prolong the inevitable. Buying a little time might have been appropriate in order to get our ducks in order and prepare ourselves to face the crisis efficiently, but how much longer are we going to draw this thing out and at what expense? The cure is becoming the problem.

No amount of fiscal stimulus is going to stave off the correction in housing. Buyer beware when considering investing in today’s market. Counter to popular belief, there are few great deals out there and we have not seen a price bottom. There will be considerable loss ahead in many segments of housing, especially in the mid to high tier range. The powers that be are either lacking in competency to understand and deal with the reality of the situation, or they just don’t have your best interest at heart. So, what to do? I’m going to keep waiting… and in the meantime I submit to our leaders this proposal for making home more affordable: Hands off the housing market!

What we need is awareness, we can’t get careless

You say “What is this?”

My beloved, let’s get down to business

Mental self defensive fitness

(Yo) bum rush the show

You gotta go for what you know

Make everybody see, in order to fight the powers that be

-Chuck D

Marketplace

U.S. Government Wants To Rent Foreclosed Properties

July 22, 2011

http://marketplace.publicradio.org

The Wall Street Journal

U.S. Tackles Housing Slump

Nick Timaros

July 12, 2011

http://online.wsj.com

San Fransisco Gate

Home-Price Declines Are More Than Tax Credit

Kathleen Pender

Thursday, June 16 2011

http://articles.sfgate.com

The Wall Street Journal

High Default Rate Seen for Modified Mortgages

James R. Hagerty

June 16, 2011

http://online.wsj.com

Posted: July 9th, 2011 | Author: jenny | Filed under: Uncategorized | No Comments »

My credit card company just sent me a check! That’s right. I don’t pay them; they pay me… and they’ll pay you too if you’re willing to dance.

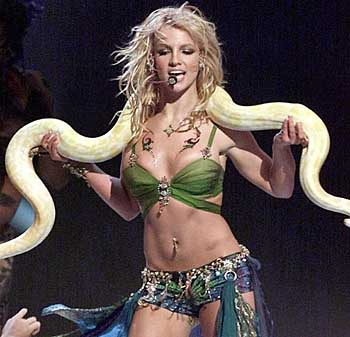

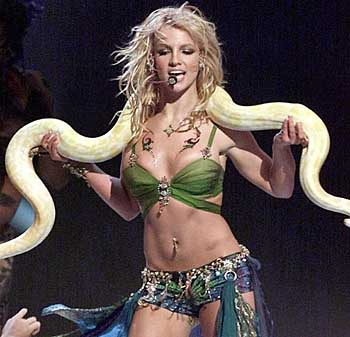

During the Great Depression some women moonlighted as dance partners to earn money. Commonly called “taxi dancers,” or “dime-a-dance girls,” they worked in large dance halls where a ten cent ticket would buy a patron one dance and a few minutes of company. In that climate of extreme economic scarcity the privilege of a few minutes of affordable entertainment was in high demand, and the women soon found themselves earning more in a few hours of dancing than they would at a full time factory or retail job. In today’s climate of economic hardship I’ve been doing a little dancing for money, myself. Oh, no, no… I’m not talking about striptease. I’m afraid I don’t have quite the ambition (or the abs) for that kind of thing. I’ve been dancing with snakes.

A couple of years ago, when my oldest son was in kindergarten, we had him in a charter school in Hollywood which meant we had about an hour and a half of commuting time each day between the school and our home near downtown LA. I took to listening to the car radio to pass the time, where I ran across Dave Ramsey’s financial advice show. You may be familiar with his work already as he is quite well known, but it was the first time I’d heard of him. He has a very interesting and unusual take on the subject of personal finance. As a born again Christian, he bases his advice on the teachings of the Bible.

The rich rules over the poor, and the borrower is servant to the lender.

Proverbs 22:7

Ramsey’s number one piece of advice is to get out of debt. To carry credit card debt is to be enslaved, he explains. He advises us to save and  spend within our means, rather than resort to borrowing. He asks that we cut up and throw out all our credit cards. Where Suze Orman focuses on the importance of FICO score building, Dave Ramsey asks us to give up our FICO scores and get off the credit grid entirely. Cash is king. He calls the credit card companies “snakes,” and warns that if we play with them we will get bit.  But then, I can’t help but think of the Pentecostals of Appalachia who handle venomous snakes in service of their commitment to their Christian faith.

spend within our means, rather than resort to borrowing. He asks that we cut up and throw out all our credit cards. Where Suze Orman focuses on the importance of FICO score building, Dave Ramsey asks us to give up our FICO scores and get off the credit grid entirely. Cash is king. He calls the credit card companies “snakes,” and warns that if we play with them we will get bit.  But then, I can’t help but think of the Pentecostals of Appalachia who handle venomous snakes in service of their commitment to their Christian faith.

Behold, I give unto you power to tread on serpents and scorpions, and over all the power of the enemy: and nothing shall by any means hurt you.

Luke 10:19

I suppose I enjoy just a bit of risk in my financial ventures. Perhaps it is not for everyone. I have taken out not one, but two, dividend paying credit cards. These are credit cards that pay a small percentage back to me for every purchase made. Ten cents a dance, so to speak. Those funds collect over time, and when a minimum limit is reached may be requested in the form of a rebate check. The trick to dancing with snakes is to remain aware and attentive at all times. Never carry a balance, so as to never pay interest. The interest is where the card companies make their money, and it is usually set at an intolerably high rate. Believe me, I learned the hard way on that front and paid through the nose for several years to get rid of the debt I ran up on my cards during college. Now I charge only what I know I will be able to pay off immediately when the bill comes due. By doing this I build my FICO score and collect the dividend points I will later be able to retrieve as a check.

One obvious danger of the dividend credit card account is that it presents an incentive to run up more charges than you can afford to pay off immediately, because you earn more back more quickly with increased use of the card. I have on occasion, especially for larger purchases, deposited the funds I’ll need to pay off the card balance in a savings account until the bill comes. That way I am not caught off guard without enough. We have come to think of credit cards as a simple way of getting hold of quick cash so we can indulge our drive for immediate gratification. This is where the trouble starts. If we think of credit cards only as a tool to build a strong credit history and reap dividend dollars, we can actually profit from their use instead of ending up slaves to debt.

I like to use my cards for purchases I’d make anyway, like groceries and gas. If I have a larger purchase coming up that I know I can pay off right away I’ll throw that on the card too. I just charged a hotel room, for example, and before that amassed a good chunk toward my dividend refund by charging some dental work for my son I knew would eventually be covered by insurance. I started off small and worked up to bigger items as I became more familiar with the debt burden I’d be able to handle.

Other dangers are of the usual credit card variety, like forgetting to pay on time so that you are fined or your interest rate is jacked up. That would defeat the purpose of the dividend card pretty quickly. I use a computer calendar in conjunction with an online checking account to send myself e-mail reminders when bills are coming due. This makes it easy to never miss a payment. It perhaps sounds like a lot to go through, but once the system is set up there’s very little time needed to maintain it and get your bills paid perfectly. A good organizational system saves time, effort and money in the long run.

Dishonest money dwindles away, but he who gathers money little by little makes it grow.

Proverbs 13:11

So I’m heading out now for that hotel room I booked with my dividend card for a weekend of sun and fun on the So Cal coast… and now I’ve got a little bit of extra spending money in the bank too! Thanks, dividend card! Hmmm… maybe I’ll invest it in some proper dance lessons and make a business for myself. I might even buy my very own snake.

Dave Ramsey

http://www.daveramsey.com

Wikipedia: Snake Handling

http://en.wikipedia.org